ct sales tax exemptions

This page discusses various sales tax exemptions in Connecticut. As with all Sales Use Tax research the specifics of each case need to be considered when determining taxability.

Map Of The Top 5 Highest And Lowest Median Property Tax Payments In America Find This Image On Blog Phmc Com Property Tax Tax Payment Mortgage Payment

Table 1 lists the exempted items.

. FilmTVDigital Media Tax Exemptions Find out more about the available tax exemptions on film video and broadcast productions in Connecticut. Sales Tax Exemptions in Connecticut. To learn more see a full list of taxable and tax-exempt items in Connecticut.

Keep 100 of the sales tax they collect on meal sales during one of the following weeks. While Connecticuts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Use tax is due on items purchased outside of the state and.

The following is a list of items that are exempt from Connecticut sales and use taxes. Some states that have a film maker tax exemption include. 7 on certain luxury motor vehicles boats jewelry clothing and footwear.

This page describes the taxability of services in Connecticut including janitorial services and transportation services. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. This tax is collected on most goods and services.

The following is a list of items that are exempt from Connecticut sales and use taxes. Sales and use tax exemption. There are exceptions to the 635 sales and use tax rate for certain goods and services.

Beginning on the July 1st 2011 the state of Connecticut levies a 635 state sales tax on the retail sale lease or rental of most goods. Business Use Tax Returns. For a complete list of exemptions from Connecticut sales taxes refer to Conn.

Counties and cities are not allowed to collect. May 15-21 2022 PA 21-2 JSS 436 effective July 1 2021. It imposes a 635 tax with some exceptions on the retail sales of tangible personal property purchased 1 in Connecticut ie sales tax or 2 outside Connecticut for use here ie use tax.

Ad Post Details Of Your Tax Preparation Requirements In Moments Completely Free. In Connecticut certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. This is not a complete list of exemptions but it does include purchases commonly made by individual consumers.

Finding Tax Preparers in Your Area Is Easy with Bark. Municipal governments in Connecticut are also allowed to collect a local-option sales tax that ranges from 0 to 0 across the state with an average local tax of NA for a total of 635 when combined with the state sales tax. Everything To Know About CT Sales Tax.

Machinery component parts and replacement and repair parts of machinery used directly in a manufacturing process. 21 exempts retail purchases of most clothing and footwear priced. 45 on motor vehicles purchased by an active duty US.

Military member stationed in. No local jurisdictions apply an additional sales tax therefore the state rate is fixed at 635. For a complete list of exemptions from Connecticut sales taxes refer to Conn.

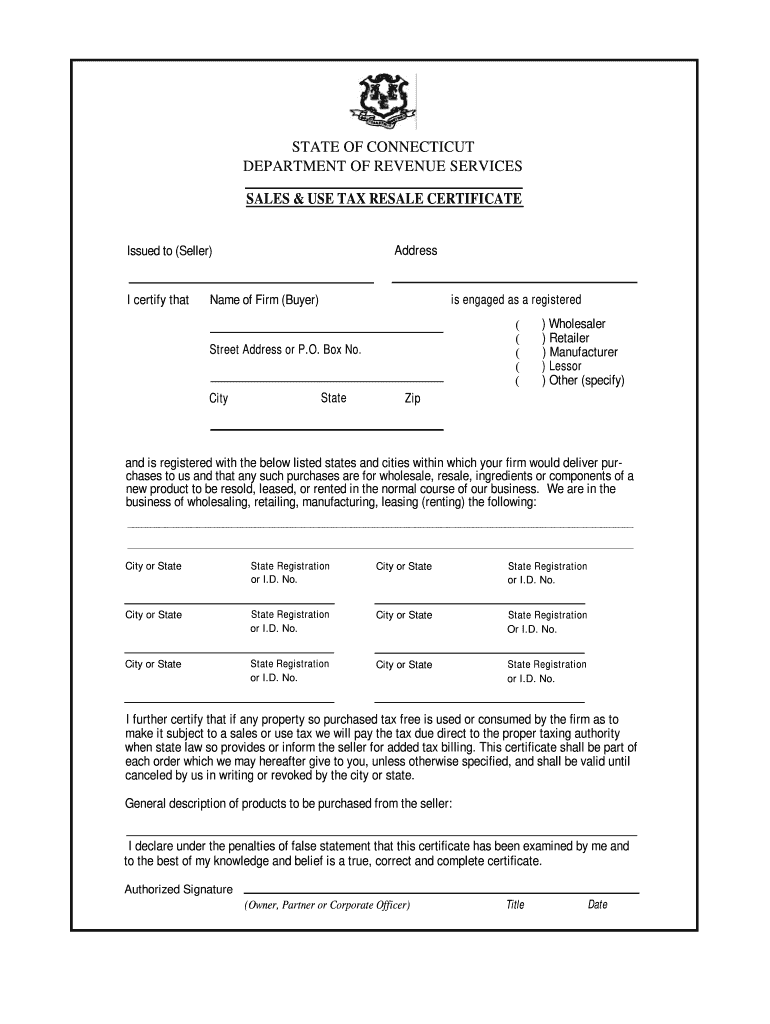

Renewal of Your Sales Tax Permit. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. How to use sales tax exemption certificates in Connecticut.

44 rows Sales and Use Tax Exemption for Purchases Made Under the Buy Connecticut. Groceries prescription drugs and non-prescription drugs are exempt from the Connecticut sales tax. Investments that help your business create jobs and modernize may be eligible for tax relief including.

There are some items that are exempt from sales tax including food prescription medications and some clothing. Amending a Sales and Use Tax Return. Admissions and Dues Taxes Form.

The connecticut sales tax rate is 635 as of 2021 and no local sales tax is collected in addition to the ct state tax. Ad Avalara experts provide information to help you stay on top of tax compliance. For joint or surviving spouse taxpayers the personal and senior exemption credit will increase from 244 to 248 for the tax year 2020.

- Click here for Income tax filing information. Sales and Use Tax Exemptions for Beer Manufacturers Under a new law beginning July 1 2023 specified manufacturing-related sales and use tax. Manufacturing and Biotech Sales and Use Tax Exemption See if your manufacturing or biotech company is.

Including industry updates new tax laws and some long-term effects of recent events. While the Connecticut sales tax of 635 applies to most transactions there are certain items that may be exempt from taxation. This is not a complete list of exemptions but it does include purchases commonly made by individual consumers.

You may apply for tax relief on the purchase of tangible personal property for qualifying retention and expansion projects or projects that significantly contribute to a targeted industry cluster. Connecticut offers an exemption from state sales tax on the purchase of electricity natural gas and water used in qualifying production activities. Exemption from sales tax for items purchased with federal food stamp coupons.

Electronic filing is free simple secure and accessible from the comfort of your own home. Connecticut has a statewide sales tax rate of 635 which has been in place since 1947. Exact tax amount may vary for different items.

This exemption relieves the company andor the developer from the states 635 sales tax up to the CI Board-approved amount. Sales and Use Tax Exemption. CT Use Tax for Individuals.

Dry Cleaning Establishment Form. Applying for a Sales Tax Permit Resale Number Retailers Advertisements. 2022 Connecticut state sales tax.

The states annual Sales Tax Free Week which runs through Aug. Exemption from sales tax for services rendered between parent companies and wholly-owned subsidiaries. Health Care Provider User Fees.

Agile Consulting Groups sales tax consultants can be found on our page summarizing Connecticut sales and use tax exemptionsIf you have questions comments or would like to discuss the specific circumstances you are encountering in regard. In Connecticut sales tax is 635. Manufacturers and industrial processors with facilities located in Connecticut may be eligible for a utility tax exemption.

- Click here for updated information. Applicable to certain services prior to June 30 1987. Vendors at Flea Markets.

Filing Season - DRS asks that you strongly consider filing your Connecticut individual income tax return electronically. The Connecticut state sales tax rate is 635 and the average CT sales tax after local surtaxes is 635. Connecticut Innovators CI can act as a conduit for a sales and use tax exemption for the companys anticipated qualifying capital equipment andor construction materials.

Rental Surcharge Annual Report. Page 1 of 1. Examples of Clothing or Footwear That Are Exempt When Sold for Less Than 100.

Exemptions from Sales and Use Taxes. Sales tax relief for sellers of meals. Obtaining a Duplicate Sales Tax Permit.

The personal and senior exemption amount for single marriedRDP filing separately and head of household taxpayers will increase from 122 to 124 for the 2020 tax year 2020. Factors determining effective date thereof. These taxes apply to any item of tangible personal property unless the law expressly exempts it.

What is Exempt From Sales Tax In Connecticut. This tax exemption is authorized by Conn.

Connecticut Solar Incentives Net Metering Tax Exemptions Moxie

Connecticut Legislative Update The Cpa Journal

Connecticut Who Pays 6th Edition Itep

Pin Van Sarah David Op Developpement Personnelle

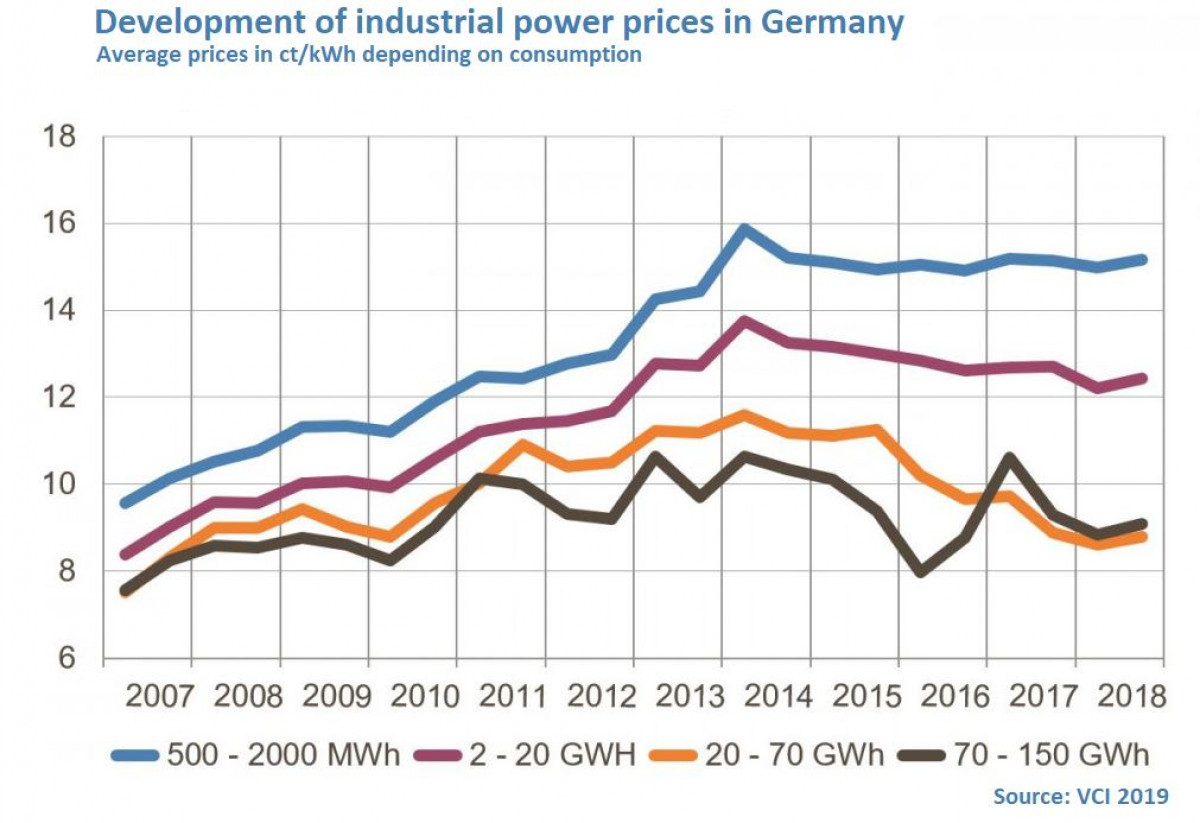

Industry Power Prices In Germany Extremely High And Low Clean Energy Wire

Connecticut Manufacturing Sales Tax Exemption For Machinery

Connecticut Manufacturers Credits And Sales Tax Breaks For Utilities

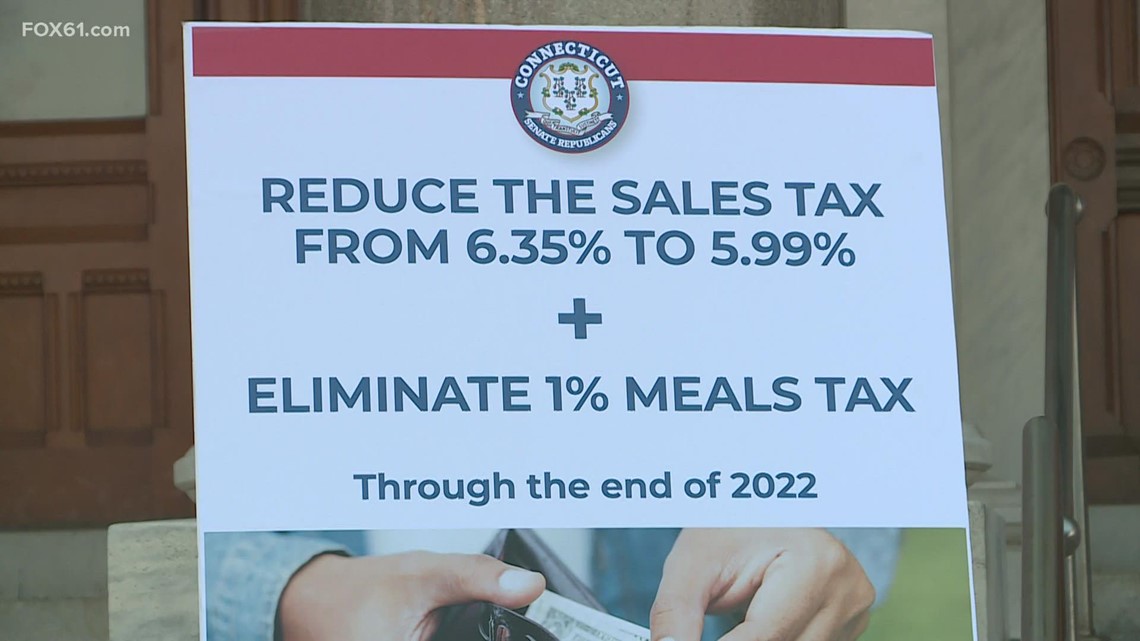

Ct State Gop Proposes Sales Tax Reduction To 5 99 Fox61 Com

Connecticut Who Pays 6th Edition Itep

How To Get A Resale Certificate In Connecticut Startingyourbusiness Com

State Of Connecticut Department Of Public Health Religious Exemption Statement Public Health Statement Print Health

Ct Sales Use Tax Resale Cerfiticate Fill Out Tax Template Online Us Legal Forms

Exemptions From The Connecticut Sales Tax

Sales Tax Exemption For Building Materials Used In State Construction Projects